The founders of Trade Iplex Ai set out to create a site where anyone, regardless of background, could access investment educator firms. Since its inception, Trade Iplex Ai has consistently facilitated access to educational resources via education firms. The commitment with which Trade Iplex Ai does this is worth emulating.

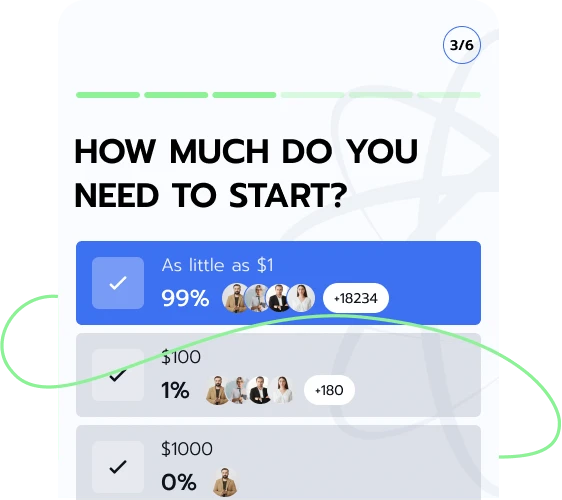

Whether beginners or ones seeking to know more, Trade Iplex Ai will connect users to fitting education firms. The sweetest part about registering on Trade Iplex Ai is that it's all for free. Trade Iplex Ai will not charge a cent. Trade Iplex Ai will not suddenly introduce “hidden fees.” It's as easy as ever! Ready to begin? Let's go!

Trade Iplex Ai is dedicated to creating connections between the average person and investment education firms. It's straightforward. Trade Iplex Ai serves as a bridge between those eager to learn and those who can teach them.

Trade Iplex Ai recognizes the fact that not all fingers are equal. We know that some people may be interested in connecting to education firms but may not be financially capable enough to act on their desires. Trade Iplex Ai has provided a solution for that. We offer our services for free.

As already stated, Trade Iplex Ai will not collect any fees from intending users. We believe in making access to investment educator firms as easy as possible. This is why we don't charge at all.

There are over 190 countries in the world today. These countries all together pull more than 3800 cultures. We can't all be the same or speak the same. That is why Trade Iplex Ai has provided the website in several languages. This is so we can serve the variety of users who register on the site.

Trade Iplex Ai is concerned about the user experience. We make sure connecting individuals to educator firms is as user-centred as possible. Trade Iplex Ai has the user in mind. Want to experience this wholesome service? Why not sign up on Trade Iplex Ai for free?

To register on Trade Iplex Ai, simply provide a few details, such as name, phone number, and email address. Trade Iplex Ai handles the rest and connects users with a suitable investment educator.

The primary role of Trade Iplex Ai is to bring learners together with fitting investment education firms. This is where the connection happens. Trade Iplex Ai takes the details given in the previous step and connects the user to a suitable education firm.

The next step is to speak with a representative. At this point, the role of Trade Iplex Ai is almost done. A representative from the assigned education firm will reach out to guide the user through the onboarding process. They'll explain how the firm operates and all that the user needs to know.

At Trade Iplex Ai, we understand the challenges of accessing financial education. This is one of the reasons we are intentional about simplifying the process. Remember, Trade Iplex Ai is designed to connect individuals interested in learning to appropriate educational firms. Why not take the first step and sign up for free?

Active investing strategies have investors trying to outperform the market. Active funds may have a higher portfolio turnover rate. They may average around 60% to 80% annually, compared to about 5% for passive funds. They encompass various methods for investment management, each with its own characteristics. There's so much one can learn about this concept. Take the first step and sign up on Trade Iplex Ai for free.

It is simply a strategy where fund managers select investments after evaluating their possible value. For instance, it's like a car driver constantly steering and deciding where to go. In general, active managers aim to surpass specific standard benchmarks.

Active investing requires analyzing investments for possible price changes and returns. Here, being familiar with fundamental analysis, such as evaluating company financial statements, may be essential.

Research and Analysis

By this, we mean fund managers may spend time doing their homework. It may be searching for stocks, analyzing balance sheets or income statements, and monitoring market developments.

Frequent Trading

Some investors frequently trade stocks to capitalize on certain movements in the market. This trading strategy is built upon the assumption that it is possible to pick the exact stocks at the precise time, which may result in “beating the market.”

Customized investment plan

This active management creates a roadmap that meets clients’ risk appetite as well as their investment goals and preferences.

A choice is available to concentrate on sectors, companies, or trends in investing.

One major consideration in active investing is higher costs. Active trading of securities may lead to increased transaction costs, brokerages, and taxes on the securities. Actively managed funds may also be more costly to operate. This is especially so compared to indexing since it requires expertise in the research process, analysis of trends, and fast investment decision-making. The learning doesn't stop here. Why not go further and sign up on Trade Iplex Ai for free?

The strategy involves holding a diversified portfolio that represents entire market segments. It may also reduce the need for frequent trading and research. Fees transaction costs may be lower compared to active investing.

Passive investing may offer simplicity, consistency, and tax efficiency. While it might also provide market-matching returns and require less financial expertise, it doesn't offer the possibility of market-beating performance or downside protection during market declines.

Trade Iplex Ai connects users with resources from education firms that cover a wide range of advanced investment concepts.

These advanced subjects dig into complex ideas and tactics financial analysts and investors employ. Some of these advanced investment concepts include;

This is another multi-factor model used in the evaluation of assets. Via Trade Iplex Ai, users can understand how APT may guide how the expected returns of the asset can be determined. This can be done by using a number of macroeconomic variables that measure systematic risk. Interested persons can learn from education firms for free after signing up on Trade Iplex Ai.

This incorporates psychological principles with the standard neoclassical finance theory. It defines why investors make uneducated choices. Some behavioral biases include loss aversion, overconfidence, and herding. After using Trade Iplex Ai, users can access educational materials from education firms to learn more about these concepts.

These are important in the management of one's portfolio. For example, VaR approximates how much the value of a risky asset or a selected portfolio may fall. Monte Carlo simulations, on the other hand, involve the use of probability distribution to represent any possible result. People interested in learning about these can register for free on Trade Iplex Ai to get started.

Assets that don't fit into the traditional investment categories of stocks, bonds, and cash are known as alternative investments. After signing up for free on Trade Iplex Ai, users can connect to education firms and learn more.

The cost differential is one element driving this tendency. The fees associated with active funds are usually higher, ranging from 0.5% to 1.5% each year. Conversely, the expenses of passive funds are typically much lower—below 0.1%. Over time, these increased fees may accumulate and possibly impact overall returns. For example, a 1% yearly fee increase may wipe off 20% of investment earnings over the course of 20 years.

For instance, during the 2010s' strong bull market, some passive funds that tracked important indices saw positive returns. This was because of the market's overall strength.

Nevertheless, during erratic times like market downturns, aggressive investing tactics might be advantageous. Active managers possess the flexibility to modify their strategies in response to shifting market conditions. Want to know more? Trade Iplex Ai will connect users with suitable Investment education firms.

Technological advancements have simplified many aspects of investing. Online investment management is now possible almost anywhere. Online trading sites facilitate quick purchases and sales of bonds, equities, and other financial instruments.

These allow one to search for stocks using specific criteria. The option to narrow down searches based on factors such as price or company size may help discover stocks that align with investment objectives.

Keeping up to date with the latest news may help people understand possible market developments.

These trackers provide updates on portfolio performance, allowing users to track the progress of investments.

They examine market trends and can make portfolio changes according to preferences and objectives.

This software can help identify patterns and inform decision-making processes.

Options Greeks and derivatives analysis are advanced concepts in options trading. It helps users explore the various "Greeks" - Delta, Gamma, Theta, Vega, and Rho - which measure different factors that may affect the price of an option.

After using Trade Iplex Ai and connecting to an education firm, people can learn about combining different strategies that align with their financial objectives. Trade Iplex Ai facilitates access to customized training based on individual investment goals.

| 🤖 Registration Cost | Free of Charge |

| 💰 Financial Charges | No Additional Charges |

| 📋 Registration | Quick and Straightforward Process |

| 📊 Education Opportunities | Crypto, Mutual Funds, Forex, Stocks |

| 🌎 Supported Countries | Available Worldwide, Excluding the USA |